How speculative bubbles and asset price inflation drive equity markets

Just over a year has passed since the outbreak of the COVID-19 pandemic. While Europe is still in lockdown in many places, the global stock markets have long since reached new highs. Governments and central banks continue to print money on a grand scale, asset prices are rising to record levels and the danger of inflation is increasing. How are equities doing in this environment?

Mark Frielinghaus

Portfolio Manager Equities

During 2020, the leading central banks, especially the American Fed, increased the money supply enormously fast and extensively in order to buffer an impending recession. Due to a lack of consumption opportunities, this high liquidity has sought channels into the financial rather than the real economy. The consequences are speculative bubbles and asset price inflation – not least on the stock markets.

One example of these excesses is the price turbulence triggered by American small investors in individual stocks, e.g. Gamestop, which were discussed and recommended for purchase on online platforms such as Reddit. A further evidence is the extreme popularity of SPACS (Special Purpose Acquisition Companies) as well as the hype around investment themes such as e-mobility and Bitcoin. But many traditional stock markets are also currently reaching all-time highs. For example, the MSCI World has already risen by 69% over a one-year period. On the one hand, the crisis created extreme valuation distortions in popular technology or growth stocks, which became even more expensive relative to value stocks than at the peak of the TMT bubble in the 1999/2000s, before correcting again in autumn 2020. On the other hand, the sharp ‘V-shaped’ recovery also drove up stocks in cyclical sectors such as automobiles and airlines, with returns approaching 150% in one year.

The automotive sector is a good example of how quickly exaggerations can correct themselves. While in 2020 the ‘e-mobility mania’ was heading for its peak and Tesla and a few counterparts from Asia had almost doubled the market capitalisation of all the world’s leading car manufacturers, in 2021 the ratio has normalised in just three months to such an extent that there is at least parity in valuation. Nevertheless, this means a de facto increase in value of 100% for the classic carmakers compared to an increase in value of 900% for electromobility in the period since the stock markets bottomed out on 18 March 2020.

Performance of stocks ranked by beta into deciles

MinRisk performance during and after speculative market rallies

Risk pushes the market – defensive stocks lag behind

Looking at the investment styles in the turbulent past 12 months, it is obvious how strongly the risk topic has pushed the market. While in Europe value stocks have been performing significantly better again, especially since autumn, and in the USA growth stocks have continued to slightly outperform the overall market, defensive stocks in particular have lagged the market by between 24% in Europe and 36% in the global markets.

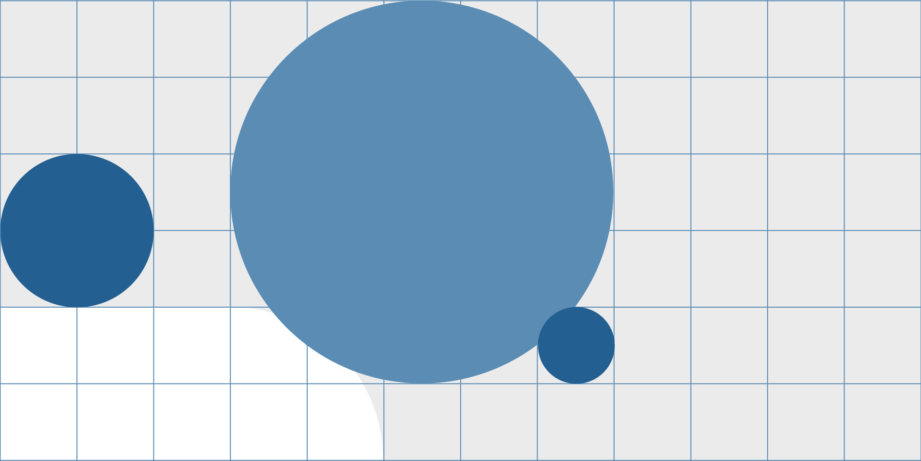

If a portfolio is built from the 10% of stocks with the highest risk and compared with a portfolio with the lowest risk (evaluated by beta), there is even a difference of 100% in Europe and 146% in the global markets (Figure 1).

Even if this lead seems immense, a look at the past reveals that the underperformance of defensive stocks in the first rally phase can often be very incisive. However, in the following years, the minimum volatility style has shown itself to be clearly superior, making an overall positive balance possible. This is especially true in phases such as the TMT bubble at the end of the 1990s, where a subsequent market correction meant that the massive loss of defensive stocks in the rally was more than compensated for by the smaller losses in the correction phase (Figure 2).