Market commentary equities: Equity strategies at the inflation tipping point

2022 was a turbulent year for equity markets, with the indices in Europe, the US and the emerging markets correcting significantly. During 2023, all eyes will continue to be on the central banks. In our market commentary, we describe which styles and regions you can still look forward to with optimism.

Mark Frielinghaus

Portfolio Manager Equities

In 2023, all eyes will continue to be on the central banks. The success of equity strategies and investment styles is currently largely determined by the expected interest rate steps of the central banks in the US and Europe as well as the inflation trend in the industrialised countries.

A turbulent equity year 2022 has finally come to an end. Over the year, the indices in Europe, the US and the emerging markets corrected significantly.

The European markets held up unexpectedly better than the American stock markets with -9%, while the S&P 500 lost almost 20% over the year. Emerging market equities were in between with -14.5%. Looking at the sectors, energy stocks clearly stood out, with double-digit positive returns in Europe and the global indices. Financials follow at a clear distance, posting a slight overall gain. Consumer-related sectors, especially food producers, also showed a clear cushion in the negative market environment. On the other hand, the growth-related sectors experienced in part significantly stronger price declines than the overall market. US technology companies in particular, but also large cap technology stocks in China, saw significant price declines. The IT sector lost about 30% in value across the regions. Corresponding effects were seen in the style returns in 2022. Growth and small caps fell considerably more, losing up to 10% relative to the standard index. Conversely, value stocks held up considerably better than the overall market. This pattern was generally observed in all regions but was particularly pronounced in markets with high technology exposure.

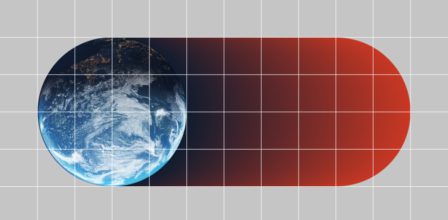

After price declines of up to 25% occurred on the global stock markets last year, the 4th quarter provided some relief. Especially in the second half of the year, investor sentiment continuously followed inflation trends and central banks’ comments on the future development of key interest rates. The level of interest rates is relevant above all for growth stocks, i.e. precisely those stocks that have been responsible for new record highs on the global stock markets in recent years and have received an additional boost from often online-based business models in the Covid pandemic. The dependency becomes transparent if one superimposes the development of 10-year US bond yields on the relative performance of the Russel 1000 Growth to the Russel 1000 Value index.

Figure 1: Relative performance of growth stocks in a rising interest rate environment

The weighting of growth stocks in the market-capitalised benchmarks had increased significantly in recent years. Therefore, the weak performance of growth stocks is also largely responsible for the negative equity returns of the passive market indices.

Why do growth stocks react so sensitively to central bank rate hikes?

To answer this question, we compare the discounted cash flow valuation of growth stocks with the current risk-free interest rate as well as the interest rate level at the beginning of the year. At the beginning of the year, 10-year US government bond yields were around 1.5%, peaking at over 4%. In the case of growth companies, a significant portion of their value comes from earnings that are expected to be generated over a longer period. The risk-free interest rate, plus risk premium, therefore have a strong influence on the discount rate. In the case of well-known growth companies such as Netflix, Tesla, Alphabet and Meta, this leads to valuation discounts of 40% on average, merely due to the change in the interest rate level. If one sets the theoretically fair company values at 4% risk-free interest in relation to today’s share price, Netflix and Meta, for example, are still clearly overvalued although both stocks have already given up more than 50% since their all-time high in November 2021.

“In the case of well-known growth companies such as Netflix, Tesla, Alphabet and Meta, this leads to valuation discounts of 40% on average, merely due to the change in the interest rate level.”

Mark Frielinghaus

Portfolio Manager Equities

However, the aforementioned index heavyweights are not an isolated case. If one looks at the valuation ratio of expensive growth stocks compared to cheap value stocks over time, the result is a valuation that continues to be more expensive than average.

Figure 2: Valuation of growth stocks in regional comparison

There are also clear regional differences. The European market is comparatively expensive for growth stocks, while the correction in US stocks and emerging markets is somewhat more advanced. This is mainly due to the different market structures. Both the US and Asian markets in China, Taiwan and Korea contain a large number of technology stocks, which have been a prominent contributor to index performance due to significant price appreciation in the years leading up to the Covid pandemic. Speculative valuations have developed in this segment due to the lockdowns and further shifts from physical business models to online. In the past 12-18 months, the affected stocks corrected significantly, resulting in a greater narrowing of valuation differentials between growth and value stocks in the US and emerging markets.

In Europe, the growth stocks were somewhat more diversified from a sector perspective and consisted of a few technology stocks, but mainly of stocks in the health sector, the food sector and luxury goods. In 2022 a recession also became increasingly likely on the backdrop of inflation and interest rate hikes. This can be seen, for example, in the current inversion of yield curves. However, since companies in the healthcare and consumer staples sectors generate relatively stable earnings regardless of the economic cycle, European growth stocks have held up better in the current downward trend.

Outlook: Cautiously optimistic

To estimate how the markets will behave in 2023, it is helpful to look at historical stock performance in the case of inverted yield curves. Six such interest rate constellations can be found in the past 50 years. When yield curves are inverted, the stock markets correct by -20% on average. In the following 12-18 months, after the initial drawdown, however, the stock market rebounds on average by around 5%. Only in the phases of the 1973 oil crisis and the bursting of the TMT bubble at the turn of the millennium did the negative market trends continue for another one to two years after the inversion. If one looks at the current state of the stock markets, with a price decline of almost 20% on the leading American stock exchanges, there is definitely reason for cautious optimism for the stock market in general, even if not necessarily for growth stocks.

Another indication is the generally pessimistic sentiment and positioning of institutional investors, which is usually considered a contra-indicator for a turning point. Measured by CME Trades Net Positioning, i.e. the balances of futures contracts on the S&P 500, 2022 a long-term low was reached, i.e. the volume of contracts betting on falling prices clearly exceeded the volume of derivatives betting on rising prices. Not since the euro debt crisis in 2011 has sentiment measured by derivative positions been as negative as it was last year in 2022. What dampens optimism somewhat are the ambitious valuations of the US equity market, measured for example by the 10-year price/earnings ratios or also by the real excess returns of equities over inflation-linked bonds. In the case of the latter, we are still slightly in positive territory, but the average over the past 20 years has been many times higher than at the present time.

Fortunately, other equity market regions besides the US with significantly more favourable valuation ratios offer attractive returns, especially compared to fixed income investments. From a regional perspective, European equity markets as well as emerging market equities stand out here with a price-earnings ratio of around 12, estimated for the future three balance sheet years and the most recently reported financial year which means an earnings yield of over 8%. As interest rates currently tend to be somewhat lower than in the US, we see attractive investment opportunities in both regions.