Market commentary bonds: Falling interest rates – reality or wishful thinking?

Interest rates and spreads fell sharply in the fourth quarter. Expectations of rate cuts and hopes of a soft landing for the US economy have boosted markets. Is this a realistic scenario or are investors looking at the markets through rose-tinted spectacles?

Dr. Harald Henke

Head of Fixed Income Strategy

What happened in the bond markets in the fourth quarter of 2023?

The fourth quarter of 2023 was marked by a noticeable decline in inflation rates, which has now spread to Europe following the price slowdown in the US in the third quarter.

Source: Bloomberg L.P.

Inflation on both sides of the Atlantic is now just above 3 %, partly as a result of decreasing food and energy inflation.

The noticeable recovery on the inflation side has led to a view that the cycle of interest rate hikes has come to an end. Central bank rhetoric has supported this view. At the December meeting, Fed Chairman Jerome Powell said that interest rates had reached or were close to their peak.

A big surprise was the Fed’s assessment of the medium-term interest rate, expressed in the quarterly dot plots, an interest rate path that each Fed member estimates. Figure 2 shows the median estimate of interest rates over the next few years.

Figure 2: Fed members’ median interest rate expectations (dot plots)

As can be seen, not only have the Fed members priced out the previously expected last rate hike in 2023, but they also expect more rate cuts than before in the coming years. Not one, but three rate cuts from current levels are now expected in 2024. Another additional rate cut has also been priced in for 2025.

Falling inflation rates and the corresponding rhetoric from central banks have led to a massive drop in interest rates across all maturity segments on both sides of the Atlantic.

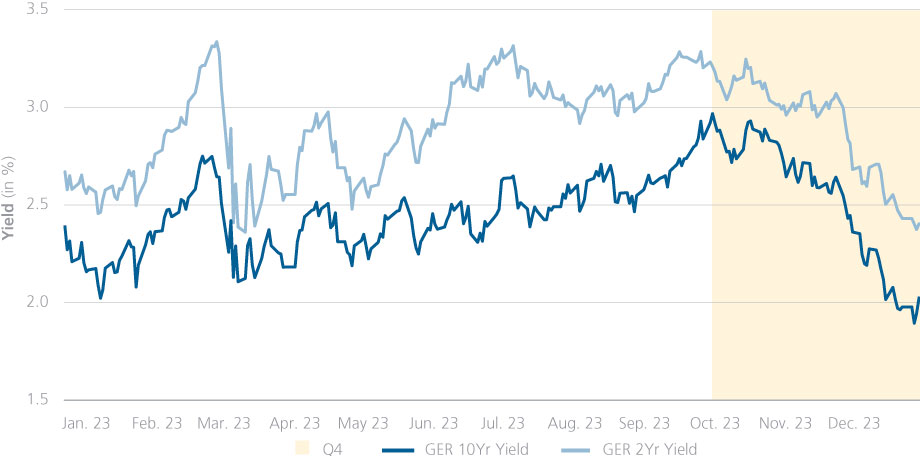

Figure 3: Two-year and ten-year interest rates in Germany and the US | Panel A: Interest rates in the US

Figure 3: Two-year and ten-year interest rates in Germany and the US | Panel B: Interest rates in Germany

Source: Bloomberg L.P., Quoniam Asset Management

As can be seen from the chart, ten-year interest rates in Germany and the US fell by a full percentage point from their peak in October to their trough in December. As two-year rates fell to a lesser extent, the yield curve inversion increased again.

Credit spreads followed the equity rally from November onwards, having widened significantly in October. However, the countermovement was so strong that credit spreads fell to their lowest level for the year in December.

Figure 4: IG Credit credit spreads

What scenarios are being traded in the market for 2024?

Looking ahead to 2024, however, there is more uncertainty than usual. Three scenarios are being played out in the market.

- A soft landing: This is the base case for many market participants. US growth slows but the country is spared a recession. As growth slows, inflation returns to the Fed’s target and the labour market remains stable. The Fed cuts interest rates moderately.

- A hard landing: Growth slows more sharply, and the US economy slides into recession. Inflation falls below the central bank’s target, forcing the Fed to cut interest rates more aggressively than expected. Interest rates, especially at the short end, and commodity prices fall sharply, while credit spreads widen.

- No landing: Growth rates remain high, reflected in rising commodity prices and a pick-up in inflation. Interest rate cuts are priced out, short and long-term rates rise, and the labour market overheats.

What arguments support each scenario?

The soft landing is largely priced into the markets. Credit spreads have fallen to levels well below crisis levels. Interest rates have fallen sharply, but not to recessionary levels, and Fed members’ rate expectations also reflect expectations of a moderate economic slowdown.

Another sign of a moderate slowdown is the still robust US labour market.

Figure 5: US unemployment rate

As long as the labour market remains robust with a current unemployment rate of 3.7 %, the economy has bottomed out.

However, there are also indicators that point to more serious problems in parts of the US economy. A hard landing would imply a spread of problems to other areas. For example, small business sentiment has been at levels for several quarters that have only been this low in this century during and in the quarters following the financial crisis.

Figure 6: Small business sentiment

Purchasing managers’ indices, particularly in the manufacturing sector, are also still in recessionary territory in Europe and the US. While the pessimism in the European manufacturing sector is not unexpected after the energy price shock of the past two years, the situation in the US is certainly surprising.

Figure 7: Purchasing Managers’ Indices in the US and the eurozone

If one were to look for arguments in favour of the no-downturn scenario, one would look at the core inflation rate in the US. While headline inflation has eased, the core rate, which excludes volatile energy and food prices, remains high at 4 % and no longer shows a clear downward trend.

Figure 8: Core inflation in the USA

If there is no significant downward momentum here, a rebound in energy and food prices could provide an unpleasant surprise and prevent the Fed from cutting rates.

Another area to watch is the US fiscal situation ahead of the November 2024 elections. Historically, the current budget deficit of 6.26 % has only been run in response to major crises.

Figure 9: US budget deficit

The current budget deficit appears disproportionate to the robust growth of the US economy and is likely to have contributed to the GDP figures. Although the Republican majority in the House of Representatives has put a stop to any further expansion of spending ahead of the elections, the administration is likely to do everything in its power to keep government spending high to create a favourable environment ahead of the elections. This could also counteract a further slowdown in the economy.

Outlook

It remains to be seen which way the economic barometer will turn. Given the sharp fall in interest rates and credit spreads, a very favourable scenario is priced in. Any deviation from this is likely to lead to volatility in asset prices and performance. At such a time, investors should focus on risk management, diversification and selection skills, and exercise caution with highly directional bets. We are in for an exciting 2024.