Market commentary bonds: Between inflation and economic worries

High inflation and a weak economic outlook are forcing central banks to choose between expansionary and restrictive monetary policy. Markets now believe in a hard line to fight inflation. This is likely to trigger a recession in 2023. Nevertheless, corporate bonds look attractive at current levels.

Dr. Harald Henke

Head of Fixed Income

In the second quarter of 2022, both inflation and economic concerns intensified. This trend continued in the third quarter. As central banks cannot simultaneously fight inflation with restrictive monetary policy and support the economy with expansionary policy, market participants found themselves caught between rising and falling interest rates, key interest rate hikes and a future central bank cave-in, and between consumer goods price inflation and asset price deflation. The quarter was correspondingly volatile.

Inflation remains high

Inflation in the US, which peaked at 9.1% in June, is declining slower than market participants expected and remained at 8.2% in September. In the Eurozone and the UK, on the other hand, inflation continues to rise, reaching new highs of 9.9% and 10.1% in September.

Figure 1: Inflation rates in the USA and Europe

Accordingly, all central banks have aggressively raised their interest rates:

- The Fed raised the key interest rate over the quarter from 1.75% to 3.25%

- ECB made its second interest rate move from 0.5% to 1.25%

- In Great Britain, the Bank of England’s key interest rates rose from 1.25% to 2.25%

Further aggressive interest rate hikes were verbally announced by the central banks.

The economic outlook continues to cloud over

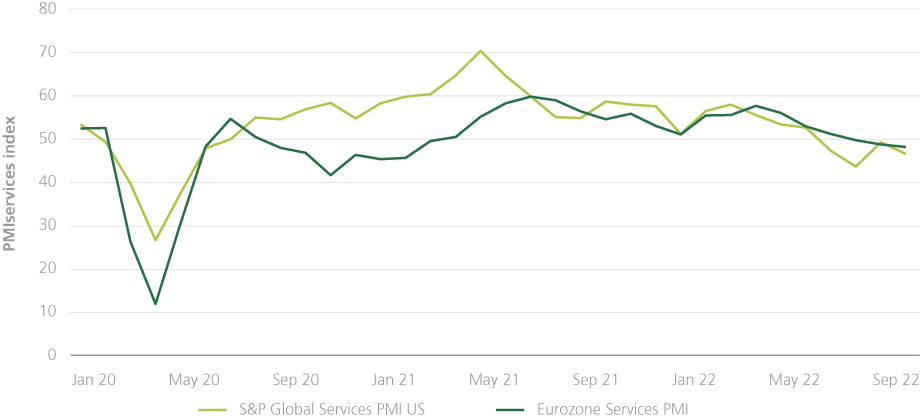

On the other hand, economic expectations also continue to decline. All signs point to an imminent recession. For example, the purchasing managers’ indices (PMIs) now indicate economic contraction in many cases, as the following chart shows.

Figure 2: PMIs for the US and the Eurozone

The chart shows that for both manufacturing and services, the indices have already fallen below the 50-point threshold that is usually seen as the boundary between contraction and expansion. On both sides of the Atlantic, purchasing managers are therefore rather sceptical about the near future.

Weakness in the real estate market

The real estate market in the USA is also showing clear signs of slowdown. With a thirty-year mortgage rate close to the 7% mark, home sales in the US have slumped and are back to the level of ten years ago.

Figure 3: Home sales in the USA

In addition, the yield curve in the USA continues to signal a high risk of recession. Two-year US interest rates have been above the level of ten-year rates for several months. This rarely occurring phenomenon of an inverted yield curve is historically a reliable indicator of an impending recession. In the Eurozone, the yield curve has also flattened, but is not yet inverse due to the later start of the ECB’s rate hikes.

Figure 4: Difference between 2-year and 10-year interest rates in the USA and Europe

The bond market is pricing in a recession in the USA and increasingly also in Europe. While the US yield curve remains deep in inverse territory, the steepness of the German yield curve has halved over the third quarter to just over 0.3%. With rising ECB key interest rates, a further flattening can be expected here as well.

Interest rate markets believe in fighting inflation

In this environment of uncertainty, there were strong interest rate movements in both directions, depending on whether the inflation or recession theme dominated the market. While interest rates on both sides of the Atlantic fell significantly between the end of June and the end of July, this trend reversed and led to massively higher interest rates over the quarter.

“Even as the economic outlook dims, investment grade credit spreads look attractive.”

Dr Harald Henke

Head of Fixed Income Strategy

Figure 5: Ten-year interest rates in the USA and Germany

Market participants increasingly believe that central banks, first and foremost the Fed, are serious about fighting inflation, even if this comes at the cost of a recession. Accordingly, expectations for the further development of key interest rates have changed over the quarter.

Figure 6: Implied money market rates in the USA

The chart shows expectations for money market rates in the US for December 2022, June 2023 and December 2023 over the course of the year. While in July and early August the December 2022 policy rate was estimated at 4%, four rate cuts for 2023 were priced in at that time, as the December 2023 money market rate was 3%. In the meantime, the market assumes that the key interest rate will be 5% at the end of 2022 and will remain there throughout 2023. Within a few weeks, key interest rate expectations for the end of 2023 rose by a full two percentage points.

Medium-term inflation expectations well anchored

The credibility of the Fed can also be seen in the inflation expectations for the USA. The next chart shows the expected average inflation rate over the next five years for the USA.

Figure 7: Five-year break-even inflation USA

Currently, inflation expectations in the US average 2.7% over the next five years, a level with which central bankers should feel comfortable. From the beginning of June to the end of September, expectations fell by a full percentage point from 3.2% to 2.2%. There was a countermovement in the wake of higher-than-expected inflation figures for September. Nevertheless, the market assesses the Fed’s fight against inflation as credible.

Credit spreads are attractive

Even as the economic outlook dims, investment grade (IG) credit spreads look attractive. In the following chart, we compare the current credit spreads of IG Credit in EUR and USD with their historical monthly levels since 2000.

Figure 8: IG credit spreads

The chart shows the monthly IG credit spreads in USD and EUR since 2000, sorted in descending order of size. The dark highlighted bar is the credit spread for September 2022. For Euro IG, this value is at the 90.8% percentile. This means that only 9.2% of all spread observations since 2000 were higher than the current spread level. These months with higher spreads were around the 2008/09 financial crisis, at the peak of the euro debt crisis and in March 2020 (Covid). The current euro spread level is therefore at the level of past crises and has thus already priced in a noticeable recession. For USD IG, the percentile value of the current spread level is 67%. Two thirds of all months had lower spreads than the current month.

Together with the increased interest rates, this currently results in yield expectations of 4.5% for Euro IG-Credit and 3.5% for Global IG-Credit (hedged to Euro).